Setting limits on BPC

How to set a limit

Clients of JSC Belagroprombank have access to a convenient and functional service “Limits on Bank Payment Cards”. The service can be used in the Belagroprombank mobile application or Internet banking. Limits can be set for transactions carried out in the Republic of Belarus and abroad.

The list of limits offered to users:

- For cash withdrawal per day in the Republic of Belarus

(The limit applies to cash withdrawal transactions at self-service terminals and bank cash desks); - For online purchases per day in the Republic of Belarus

(The limit applies to online payment transactions on Belarusian websites with the “.by” domain); - For non-cash transactions in trade (service) organizations per day in the Republic of Belarus

(The limit applies to payment transactions in trade (service) organizations using a physical bank payment card or a digital token (Apple Pay , Samsug Pay , Belkart Pay , Garmin Pay , Mi Band Pay, Swoo Pay); - For cash withdrawal per day outside the Republic of Belarus

(The limit applies to cash withdrawal transactions at self-service terminals and bank cash desks); - For online purchases per day outside the Republic of Belarus

(The limit applies to online payment transactions); - For non-cash transactions in trade (service) organizations per day outside the Republic of Belarus

(The limit applies to payment transactions in trade (service) organizations using a physical bank payment card or a digital token (Apple Pay , Samsug Pay , Belkart Pay , Garmin Pay , Mi Band Pay , Swoo Pay).

Controlling your expenses is easier and more convenient with limits!

We would like to remind you about a functional service that will make your experience of using our mobile application or Internet banking and our bank payment card even more convenient and secure.

Convenience

With a limit, it is easy to control your expenses. Just choose a limit, set it and rest assured that the limit will not allow you to spend more than you need.

Safety

If your card is lost/compromised, fraudsters will not be able to use your funds in full.

How does this work?

Step 1: Login to your Mobile App.

Step 2: Select a card.

Step 3: Go to the Limits section.

Step 4: Select the limit, in the «Set» field enter the permissible amount.

Step 5: Click the «Save» button.

* The «Available» field displays information about the remaining available amount due to previously set limit. To cancel the limit, remove the check mark in the «Set» field the entered limit amount, then click the «Save» button.

How does this work?

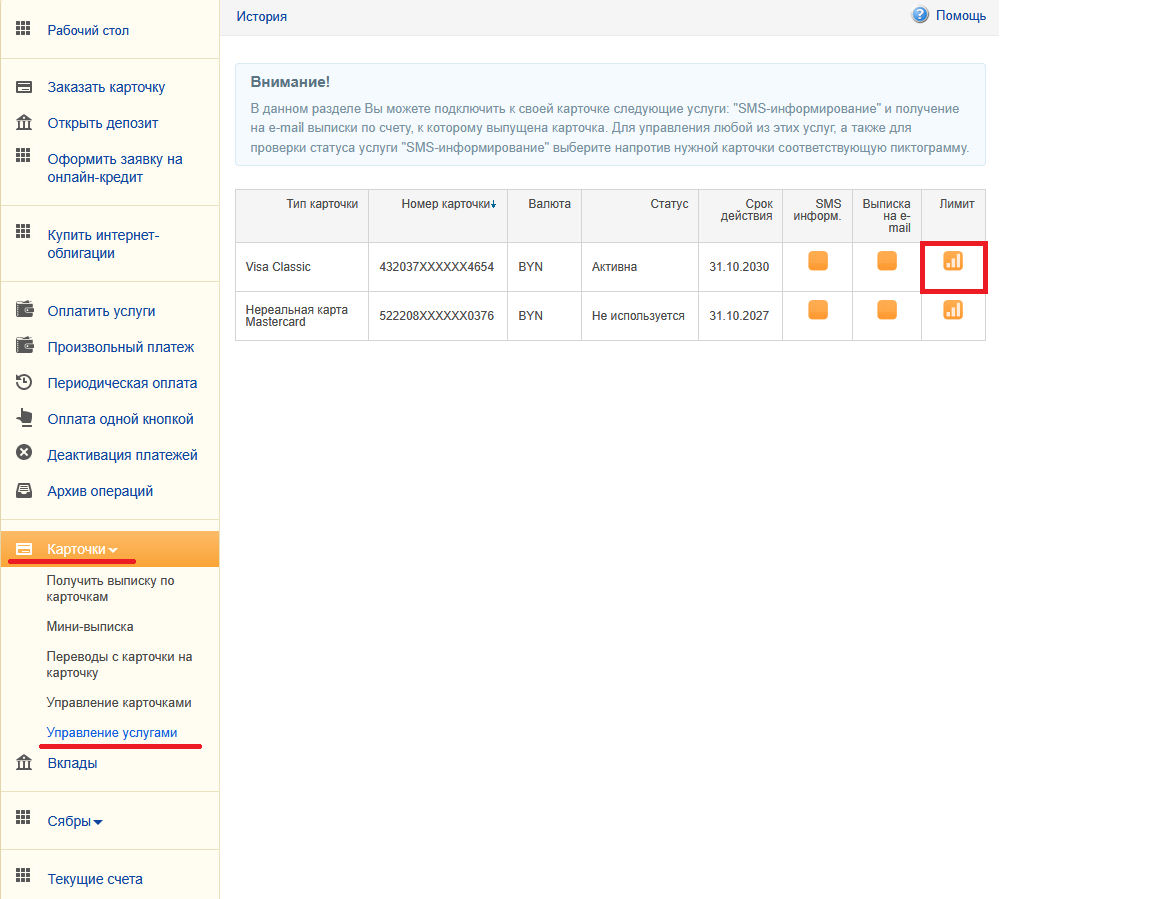

Step 1: Log in to your Internet Banking.

Step 2: Go to the «Cards» section.

Step 3: Select «Manage Services».

Step 4: Select a card, in the Limit column, click on the chart icon.

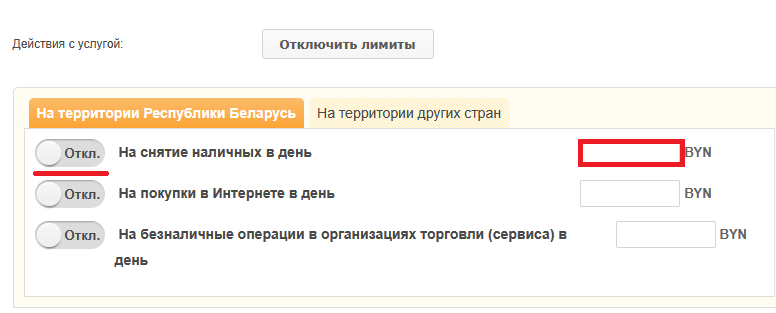

Step 5: Select a limit, switch from the «Off» position to the «On» position, enter the allowed amount in the field opposite.

Step 6: Click the «Continue» button.

* The «Disable Limits» button deactivates all previously set limits. Also, to deactivate one or more limits, you need to switch from the «On» position to the «Off» position, then you need to click the «Continue» button.